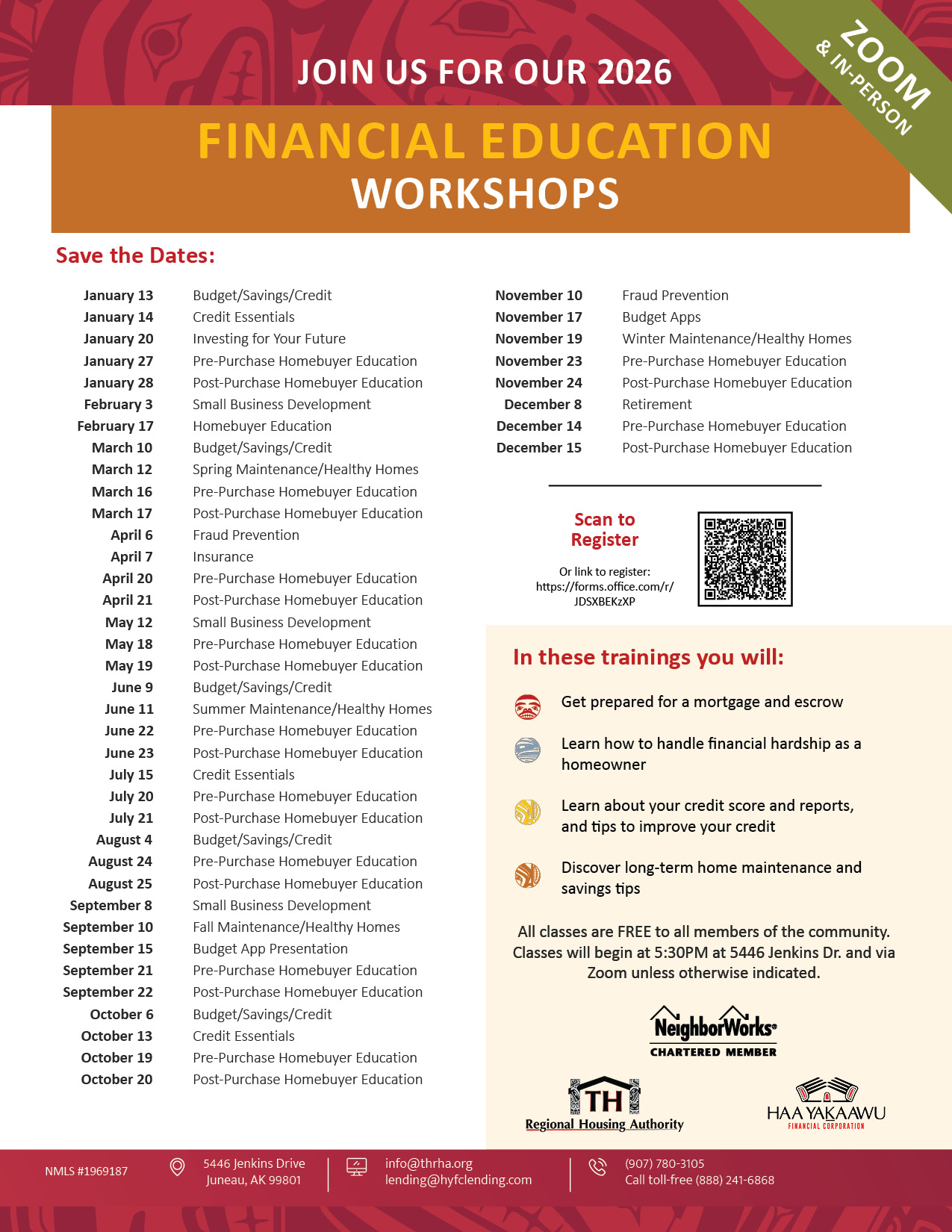

Upcoming Classes:

- January 13 — Budget/Savings/Credit

- January 14 — Credit Essentials

- January 27 — Pre-Purchase Homebuyer Education

- January 28 — Post-Purchase Homebuyer Education

- February 3 — Small Business Development

- February 17 — Homebuyer Education

- March 10 — Budget/Savings/Credit

- March 12 — Spring Maintenance/Healthy Homes

- March 16 — Pre-Purchase Homebuyer Education

- March 17 — Post-Purchase Homebuyer Education

- April 6 — Fraud Prevention

- April 7 — Insurance

- April 20 — Pre-Purchase Homebuyer Education

- April 21 — Post-Purchase Homebuyer Education

- May 12 — Small Business Development

- May 18 — Pre-Purchase Homebuyer Education

- May 19 — Post-Purchase Homebuyer Education

- June 9 — Budget/Savings/Credit

- June 11 — Summer Maintenance/Healthy Homes

- June 22 — Pre-Purchase Homebuyer Education

- June 23 — Post-Purchase Homebuyer Education

- July 15 — Credit Essentials

- June 20 — Pre-Purchase Homebuyer Education

- June 21 — Post-Purchase Homebuyer Education

- August 4 — Budget/Savings/Credit

- August 24 — Pre-Purchase Homebuyer Education

- August 25 — Post-Purchase Homebuyer Education

- September 8— Small Business Development

- September 10 — Fall Maintenance/Healthy Homes

- September 15 — Budget Apps

- September 21 — Pre-Purchase Homebuyer Education

- September 22 — Post-Purchase Homebuyer Education

- October 6 — Budget/Savings/Credit

- October 13 — Credit Essentials

- October 19 — Pre-Purchase Homebuyer Education

- October 20 — Post-Purchase Homebuyer Education

- November 10 — Fraud Prevention

- November 17 — Budget Apps

- November 19 — Winter Maintenance/Healthy Homes

- November 23 — Pre-Purchase Homebuyer Education

- November 24 — Post-Purchase Homebuyer Education

- December 8 —Retirement

- December 14 — Pre-Purchase Homebuyer Education

- December 15 — Post-Purchase Homebuyer Education

Communities Served:

Angoon

Craig

Douglas

Haines

Hydaburg

Juneau

Kake

Kasaan

Ketchikan

Klawock

Metlakatla

Petersburg

Saxman

Sitka

Skagway

Wrangell

Yakutat

All communities are welcomed and encouraged to participate in the THRHA Financial Literacy classes.

Financial Literacy training has been provided for 1,900 people during the past 6 years.

The Financial Literacy Program is designed to support our tribal citizens while encouraging self-sufficiency to help build stronger communities throughout Southeast, AK. The overall goal is to instill hope in their financial situation while educating them with valuable information to make permanent healthy changes to their financial habits.

Program Features: Three-Phase Financial Literacy Training:

-

- Phase 1: Building Native Communities: Financial Cent$ Class

- Phase 2: Building Native Communities: Credit Essentials Class

- Phase 3: Individual Financial Coaching focusing on financial independence and homeownership.

To sign up for an upcoming Zoom class please contact:

E-mail: coaching@thrha.org or call 907-780-6868

Elder Financial Abuse:

-

- Approximately one in 10 Americans aged 60+ have experienced some form of elder abuse. Some estimates range as high as five million elders who are abused each year. One study estimated that only one in 24 cases of abuse are reported to authorities. Offering elder education empowers this vulnerable demographic to take charge of their financial decisions and arm them with the resources they need. Staying healthy and financially secure as you age can be a challenge. Get the information and tools you need to manage your money, maintain your health, and improve your life.

Need assistance filing your personal income tax return? THRHA and the Volunteer Income Tax Assistance (VITA) program are coming to your community to provide tax preparation support.

Items to Bring:

-

- All income information (if filing jointly, for both spouses)

- Social Security cards for ALL those claimed on your tax return

- Picture ID for you and your spouse

- W-2s

- Interest and any other investment statements

- Unemployment statements

- Social Security statements

- Pension or retirement statements

- Any 1099-DIV Forms

- Power of attorney (if you have one)

- Copy of previous years tax return

- Any other tax-related documents

- Your return will not be processed with partial documentation

Please note that we do not provide assistance for comprehensive income tax returns, business tax returns, or returns involving litigation or ongoing legal action.

The average cost to have a return prepared in Alaska is $300. This program is intended to be another tool for clients to use in their pursuit for financial freedom.